In the cobblestone streets of Sofia and the snowy slopes of Bansko, Bulgarians are grappling with a monumental change: the European Union’s green light for their country to adopt the euro on January 1, 2026. The decision, confirmed today by the European Commission and European Central Bank, marks a pivotal step for Bulgaria, the EU’s poorest member, to join the eurozone as its 21st member. Yet, as the nation prepares to trade its historic lev for the euro, its people are deeply divided, torn between hopes of economic growth and fears of rising prices in a country still scarred by past financial turmoil.

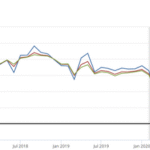

Bulgaria’s journey to the euro has been decades in the making. Since joining the EU in 2007, the nation committed to adopting the common currency, with its lev pegged to the euro at 1.95583 since 1999, following a 1997 currency board that tamed hyperinflation. The European Commission’s convergence report, released today, confirms Bulgaria meets the Maastricht criteria—low inflation, stable deficits, and debt below 24% of GDP—paving the way for the switch. The euro promises easier trade, lower borrowing costs, and a seat at the European Central Bank’s table. For many, like Igor Ruge, a hotel manager in Bansko, it’s a golden opportunity. “The euro will make it easier for tourists to see Bulgaria’s value,” he said, wiping down a counter in his ski resort lobby. “More visitors, more investment—that’s what we need.”

But not everyone shares Ruge’s enthusiasm. Recent polls show 50% of Bulgarians oppose the euro, up from 46% last month, driven by fears of price hikes like those seen in Croatia after its 2023 euro adoption. In rural villages, where incomes are tight, people like Tanya Ignatova, a 78-year-old retiree, worry about the cost of bread and vegetables. “Prices will jump, and my pension won’t,” she said, clutching a bag of groceries in Sofia’s market. Petar Ganev, an economist in Sofia, points to a deeper issue: “When trust in institutions is shaky, transitions like this feel risky.” Bulgaria’s history of political instability and corruption fuels skepticism, with many recalling the 1996–97 crisis when inflation hit 300% and banks collapsed.

Government officials are pushing forward with optimism. Finance Minister Temenuzhka Petkova, speaking at a recent forum, promised the euro would bring stability and investment. “We’re launching a campaign to ease concerns and fight misinformation,” she said, addressing fears of savings losses or forced spending deadlines—rumors that have stirred unease. The government has planned a smooth transition: a one-month period where both lev and euro are legal tender, followed by a year of dual pricing to help people adjust. Bulgarian euro coins, featuring the Cyrillic alphabet and designs like the Madara Rider, were approved in February 2024, a nod to national pride.

The divide is stark. In urban centers, younger Bulgarians like Konstantin Bozhinov, a 26-year-old barista, shrug off the change. “We’re already tied to the euro, and inflation’s always here,” he said, steaming milk in a Sofia café. But in rural areas, distrust runs deep, fueled by nationalist voices like the pro-Russian Vazrazhdane party, which rallied thousands in Sofia last weekend, chanting for the lev’s survival. President Rumen Radev’s call for a referendum to delay the euro was rejected by parliament, which accused him of stoking anti-EU sentiment. “Fears are being spread, lies told boldly,” said Ognyan Minchev, a Sofia analyst, pointing to disinformation about the euro’s risks.

The euro’s arrival could reshape Bulgaria’s economy, boosting trade and tourism while cutting transaction costs. Yet, experts warn of short-term price spikes, especially for rural households, as seen in Slovakia and Estonia post-euro. The real estate market, already overheated, may face added pressure from foreign capital. Bulgaria’s low media literacy, with only 31% of citizens having basic digital skills, makes it fertile ground for misinformation, complicating public buy-in.

As 2026 looms, Bulgaria’s government is racing to win hearts and minds, with campaigns to demystify the euro and highlight its benefits. But questions persist: Can trust be rebuilt in a nation wary of change? Will the euro close the wealth gap or widen it for the vulnerable? For now, Bulgaria stands at a crossroads, its people caught between a hopeful leap into Europe’s core and the weight of a past that cautions against it.