In the gritty steel mills of Duisburg, where furnaces glow and workers shape metal that powers Europe’s cars and machines, a new challenge looms. Thyssenkrupp Steel Europe, Germany’s largest steelmaker, said Wednesday that U.S. tariffs doubling to 50% on imported steel and aluminum will have a limited direct impact on its business, but the ripple effects could shake the continent’s trade landscape. As U.S. President Donald Trump escalates his trade war, the company warns of increased pressure from cheap steel flooding Europe, threatening an industry already battered by global uncertainties.

The U.S. tariff hike, announced last week and effective June 4, builds on Trump’s March 2025 levies of 25% on steel and aluminum, part of his “Make America Wealthy Again” campaign to bolster domestic industry. For Thyssenkrupp, the direct hit is minimal. “Our main market is Europe, and exports to the U.S. are low, mostly high-quality products,” a company spokesperson said in a statement, their words carrying the calm of a firm focused on local demand. Yet, the broader threat lies in what’s known as trade diversion. With U.S. markets now costlier, countries like China may redirect their steel to Europe, driving down prices and squeezing local producers. “This could flood our market with cheap imports,” said Jens Schulte, Thyssenkrupp’s CFO, during a recent call, noting that the full impact remains unclear until the tariffs take hold.

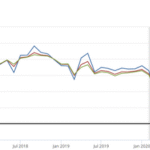

In Duisburg’s sprawling steelworks, workers like Hans Mueller feel the unease. “We’re already fighting low prices, and now this,” he said, wiping sweat from his brow after a shift. Thyssenkrupp, which produced 9 million metric tons of crude steel in fiscal year 2023-24, saw an 11% sales drop in its steel division from October to December, hit by weak demand in automotive and industrial sectors. The company, a key supplier to firms like Volkswagen, benefits from cost advantages in raw materials and electricity price compensation, but Schulte warned that a surge in Chinese steel could erase these gains. Europe’s auto parts suppliers, already reeling from China’s rare earth curbs, now face another supply chain headache, with fears of higher costs trickling down to consumers.

The context is a tense transatlantic trade spat. The EU, which exported €532 billion in goods to the U.S. last year, is preparing countermeasures, targeting American products like whiskey and dental floss, with a July 14 deadline looming if talks fail. European Commission President Ursula von der Leyen has called the U.S. tariffs “unjustified,” pushing for negotiations while readying the EU’s Anti-Coercion Instrument to block U.S. exports if needed. Thyssenkrupp’s limited U.S. exposure—its exports there are “negligible,” focusing on premium steel—shields it from direct losses, but the company echoed industry concerns about a broader trade war. “Increased diversion effects would further stress Europe’s market,” the spokesperson added, pointing to risks of overcapacity.

Reactions reflect worry and defiance. “If Chinese steel floods in, our margins are toast,” said Klaus Weber, a manager at a smaller German supplier, echoing fears of job cuts. Industry groups like CLEPA warn of supply chain disruptions, while analysts see a silver lining in firms like Phoenix Tailings, a U.S. company scaling up rare earth recycling to ease reliance on China. Across Europe, steel stocks dipped, with Thyssenkrupp’s shares falling 0.5% on Frankfurt’s exchange, signaling investor jitters.

The implications are stark. Europe’s steel industry, supporting millions of jobs, faces price pressure that could force plant closures or layoffs. The EU’s planned tariffs on U.S. goods risk escalating the conflict, potentially hiking prices for consumers on both sides. Thyssenkrupp’s green transformation, including a 2.5-million-ton direct reduction iron plant using natural gas, aims to cut costs, but high hydrogen prices delay a full shift to sustainable production.

Looking ahead, the EU is pushing for talks, with U.S. and EU negotiators meeting recently in Paris. Thyssenkrupp is monitoring developments, banking on its joint venture with EPCG to bolster its steel division’s independence. Questions remain: Can diplomacy avert a trade war? Will Europe’s steelmakers weather the flood of imports? For now, as Duisburg’s furnaces burn on, workers like Hans hold tight, hoping their industry can steel itself against the coming storm.