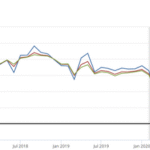

In the cafes of Frankfurt and the markets of Madrid, Europeans are breathing a cautious sigh of relief as inflation in the 20 eurozone countries dipped to 1.9% in May from 2.2% in April, sliding below the European Central Bank’s 2% target for the first time since September. But the mood is far from celebratory. As lower energy prices tame consumer costs, a new worry looms: U.S. President Donald Trump’s escalating tariffs threaten to jolt Europe’s export-driven economy, dimming hopes for growth. With the ECB poised to cut rates, the continent braces for a trade storm that could hit wallets and jobs.

The inflation drop, driven by falling energy costs, signals a victory after the 2021–23 price surge that squeezed households. “It’s a relief to see prices stabilize,” said Maria Conti, a Rome grocer, restocking shelves with pasta now slightly cheaper than last year. The data clears the way for the ECB to lower its benchmark rate, currently 2.25%, at its Thursday meeting under President Christine Lagarde. Analysts expect a quarter-point cut, with hints of more to come, to boost borrowing and spur growth. “Inflation’s under control, so we can focus on growth,” an ECB official said, speaking anonymously. Lower rates mean cheaper loans for homes, cars, and businesses, a lifeline for an economy facing headwinds.

But the spotlight has shifted to Trump’s tariff offensive. In March, he hiked duties on EU steel, aluminum, and autos to 25%, and last week announced a jump to 50% on steel, plus a proposed 20% tariff on all EU goods, paused until July 14 pending talks. These levies, targeting a $161 billion U.S. trade deficit with the EU in 2024, threaten Europe’s export engine, which fuels 7% of its GDP through industries like automotive and machinery. “Tariffs could choke our factories,” said Hans Weber, a Munich auto parts worker, his hands still greasy from a shift. The EU’s executive commission slashed its 2025 growth forecast for the eurozone to 0.9% from 1.3%, blaming Trump’s policies.

EU negotiators, led by Maroš Šefčovič, met U.S. Trade Representative Jamieson Greer in Paris this week, pushing a “zero for zero” deal to eliminate industrial tariffs if the U.S. reciprocates. Trump’s team, wary of the EU’s 10% car import tax versus the U.S.’s pre-hike 2.5%, rejected the offer, though talks continue. “We’re ready to respond if needed,” said French Trade Minister Laurent Saint-Martin, hinting at retaliatory duties on U.S. goods like whiskey or soybeans. The EU’s Anti-Coercion Instrument could block American exports, escalating tensions. A Brussels insider, speaking off-record, called the talks “a tightrope walk.”

The stakes are personal for Europeans. In Germany, Thyssenkrupp Steel Europe warned that while its U.S. exports are minimal, cheap Chinese steel diverted from the U.S. could flood Europe, slashing prices and threatening jobs. “If imports surge, we’re in trouble,” said Lena Fischer, a Duisburg steelworker, her voice tinged with worry. Across the eurozone, industries from carmakers like Volkswagen to pharmaceutical suppliers face higher costs, which could raise prices for consumers. The ECB’s rate cuts aim to cushion the blow, but analysts like Sofia’s Ivan Krastev warn tariffs could spark a “slow-motion recession.”

Public reactions mix hope and fear. “Cheaper loans sound great, but if tariffs jack up car prices, what’s the point?” said Paolo Rossi, a Milan mechanic. Industry groups like CLEPA urge swift EU action to secure supply chains, while firms like Phoenix Tailings in the U.S. see a chance to scale rare earth recycling as a hedge against China’s curbs, which compound Europe’s woes.

The road ahead is uncertain. The ECB’s rate cuts could fuel investment, but tariffs threaten to derail recovery. With a Trump-Xi Jinping call looming and EU-U.S. talks ongoing, the July 14 deadline looms large. Europe is pushing for diversified supply chains, eyeing Australia for rare earths, but scaling takes years. Questions persist: Can diplomacy avert a trade war? Will rate cuts offset tariff pain? For now, as Maria Conti rings up customers in Rome, she hopes the inflation dip brings relief, but fears the trade storm could hit harder than any price spike.