In Yokohama’s sprawling Nissan factory, where assembly lines once churned out cars with pride, workers like Aiko Tanaka now face uncertainty. On Wednesday, Nissan’s new CEO, Ivan Espinosa, stood before reporters, his voice resolute, promising a sweeping “Re-Nissan” savings plan to rescue the beleaguered automaker. After a bruising $4.5 billion loss last fiscal year, Espinosa’s strategy—slashing 20,000 jobs, closing seven plants, and cutting costs by $3.4 billion—aims to revive a company battered by falling sales and U.S. tariffs. For employees and communities, it’s a gamble that stirs both hope and dread.

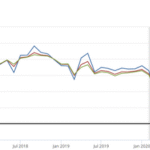

Nissan’s woes run deep. The company, Japan’s third-largest automaker, saw sales plummet to 3.34 million vehicles in 2024, down from a peak of 5.6 million in 2016, hit hard by weak demand in China and the U.S.. Espinosa, who took the helm in March after a failed merger with Honda, pinned the decline on past overambition under former chairman Carlos Ghosn, whose push for 8 million annual sales led to heavy spending on factories and staff. A $3.4 billion write-down on plant values and rising costs sealed a 670.9 billion yen loss, one of Nissan’s worst ever. “Our landing in 2024 was not good,” Espinosa admitted, vowing to align production with demand.

The “Re-Nissan” plan is drastic. By 2027, Nissan will cut 15% of its global workforce—20,000 jobs—and reduce its 17 plants to 10, targeting $3.4 billion (500 billion yen) in savings. The company is also betting on its e-Power hybrid technology, which uses a gasoline engine to charge a battery-powered motor, to refresh its aging lineup and compete with Chinese electric vehicle giants like BYD. In India, a €700 million investment will launch new vehicles, including a seven-seater MPV in 2026, aiming to boost production to 200,000 units by 2027. “We must prioritize self-improvement with urgency,” Espinosa said, emphasizing partnerships with Renault in Europe and Mitsubishi in the U.S..

Workers feel the weight. “I’ve given 15 years to this plant,” said Tanaka, 38, in Yokohama, her eyes scanning a quiet assembly line. “Now we’re told to trust this plan, but what about our families?” In the U.S., Nissan’s offer of buyouts and a freeze on pay raises has sparked unease. Industry voices are skeptical. “The cuts are bold, but Nissan’s brand is bruised,” said Tokyo analyst Yumi Sato, noting a 24% drop in Nissan’s shares this year. U.S. tariffs, now at 25% on vehicles from Japan and Mexico, add $3 billion in costs, with Espinosa urging faster trade talks.

The context is grim. Nissan’s struggles mirror those of other automakers facing Chinese EV competition and Trump’s tariff hikes, which also hit Toyota and Volkswagen. A collapsed Honda merger and Ghosn’s 2018 arrest for financial misconduct further eroded confidence. Yet, Espinosa insists Nissan’s $10 billion cash reserve offers stability. “We have enough to turn this around,” he told reporters, pointing to new EVs and solid-state battery development.

Reactions are mixed. In India, where Nissan’s Magnite SUV sold 200,000 units, dealers like Rajesh Kumar in Mumbai see hope. “New models could bring customers back,” he said. But in Japan, communities near closing plants brace for economic pain. “It’s not just jobs—it’s our town’s future,” said a shopkeeper near Nissan’s Oppama plant. Analysts warn of a tough road, with a projected 200 billion yen operating loss this quarter.

The stakes are high. If successful, “Re-Nissan” could restore competitiveness, especially in EVs, and stabilize jobs. Failure risks further decline for a brand once synonymous with innovation. With trade talks ongoing and Chinese rivals gaining ground, questions loom: Can Espinosa’s cuts rebuild Nissan’s edge? Will workers and markets trust the plan? For now, as Tanaka clocks out in Yokohama, she hopes the company she loves can find its way back, but the road ahead feels anything but certain.