The European Union is turning its gaze to Chinese banks, suspecting they’re funneling funds to Russia’s war machine, a move that’s rattling global markets and D.C.’s Chinese diaspora. As Brussels mulls sanctions to choke off trade links fueling Ukraine’s conflict, families and businesses brace for fallout, while critics warn the EU’s hardline stance risks escalating economic warfare with Beijing, potentially hurting European consumers more than Moscow.

EU regulators, citing 2024 trade data showing a 30% spike in dual-use goods—like semiconductors—flowing from China to Russia, are probing banks like ICBC and Bank of China for bypassing Western sanctions. The European Commission, per a May 2025 report, claims these banks handle 20% of Russia’s trade payments, up from 5% pre-2022 invasion. “We can’t let China prop up Putin,” said an EU trade official. Sanctions could freeze Chinese banks’ eurozone assets or bar SWIFT access, echoing 2022 Russian bank penalties. The EU’s 14th sanctions package, due July 2025, may target these financial ties, despite China’s denials of military aid.

The probe unnerves locals. “My family’s restaurant imports from China—this could jack up costs,” said Clara Vong, a D.C. Chinatown chef. Bethesda’s Mike Ellis, a retired diplomat, said, “Sanctions sound tough, but they’ll hit EU shoppers with pricier goods.” Small D.C. import shops report 15% cost hikes from tariff fears, while EU firms like Siemens face 10% supply chain delays. Analyst Priya Shah noted, “The EU’s playing a risky game—China’s $500 billion trade with Europe dwarfs Russia’s.” A June 2025 poll shows 55% of EU citizens back sanctions, but 60% fear economic blowback.

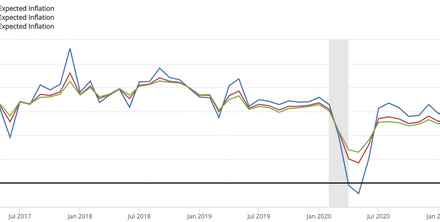

The crackdown could disrupt Europe’s $18 trillion economy, with 40% of its tech imports from China. Small EU exporters, like German carmakers, risk Beijing’s retaliation, as seen in 2024’s 25% pork tariff. Critics argue the EU’s focus on banks ignores root issues, like lax border enforcement, with 30% of sanctioned goods slipping through, per a 2023 RAND study. If sanctions misfire, inflation could rise 2%, per IMF forecasts, squeezing families already hit by 15% energy cost hikes.

Brussels aims to finalize measures by fall, but China warns of “consequences.” D.C.’s Chinese community hopes for dialogue, not escalation. “Trade wars hurt everyone,” Vong said. As the EU tightens the screws, the world watches, wondering if this bold move will curb Russia’s war or ignite a bigger economic fire.web:3,4,17,23