For millions of investors across Europe, the shift to a faster stock trading settlement system, known as T+1, promises quicker transactions but comes with a hefty price tag. A new study reveals that implementing T+1 in Europe will cost financial institutions significantly more than it did in North America, where the transition occurred in May 2024. The complexity of Europe’s fragmented markets is driving up expenses, raising concerns about who will bear the cost—banks, brokers, or everyday investors like you.

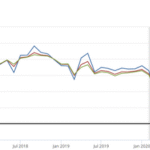

The T+1 system cuts the time to settle trades from two days (T+2) to one day after the transaction, aiming to reduce risk and boost efficiency. According to Firebrand Research, a capital markets advisory firm, large European custodians could face costs as high as $36 million each to implement T+1, compared to an average of $13 million for similar firms in North America. The difference stems from Europe’s diverse market structure, with 27 EU member states, multiple Central Securities Depositories (CSDs), and various clearinghouses, unlike the U.S., where a single entity, the Depository Trust & Clearing Corporation (DTCC), handles most settlements.

“We’re dealing with a patchwork of systems across Europe, which makes coordination a nightmare,” said Michael Klimes, an investment banking editor who contributed to the study. “Unlike North America, where one entity streamlines the process, Europe’s complexity means more technology upgrades, staff training, and cross-border alignment.” The European Securities and Markets Authority (ESMA) has set October 11, 2027, as the target date for the EU, UK, and Switzerland to adopt T+1, giving firms a tight window to prepare.

Europe’s fragmented landscape isn’t the only hurdle. The region’s capital markets include sovereign bonds and securities financing, which weren’t part of the U.S. transition, adding layers of complexity. A Citi study noted that 44% of U.S. firms reported increased middle and back-office staffing needs for T+1, and European firms expect even greater demands due to the region’s diversity. Regulations like Dodd-Frank and the Volcker Rule, which limit banks’ trading inventories, further complicate matters by straining liquidity during the transition.

The reaction has been mixed. Financial institutions see T+1’s benefits—lower counterparty risk and reduced margin requirements, which saved $3 billion in North America, according to the DTCC. “This could free up liquidity and make markets more resilient,” said Gareth Jones, Director of Product Management at Euroclear. But smaller firms worry about the costs. “Big banks can absorb this, but for smaller players, $36 million is a tough pill to swallow,” said Anna Berg, a financial analyst in Stockholm. Investors like Marco, a 34-year-old trader in Milan, fear higher fees: “If banks pass these costs on, it’s people like me who’ll pay more to trade.”

The stakes are high for Europe’s financial system. T+1 could streamline trading and cut risks, but mismanaged implementation might lead to trade failures or liquidity crunches, especially in smaller markets. The EU’s Industry Task Force, involving 21 trade associations, emphasizes automation and standardized processes to control costs. Their roadmap, published in October 2024, calls for a 24-to-36-month preparation period to address inefficiencies like manual trade confirmations.

Looking ahead, Europe’s success depends on coordination. The Task Force is pushing for harmonized settlement cycles to avoid liquidity costs from mismatched systems. Firms are already investing in automation to handle the tighter timeline, but challenges remain. Will smaller institutions keep up? Could costs trickle down to investors? As the 2027 deadline looms, Europe’s financial community faces a complex, costly transition that could reshape how millions trade and invest.