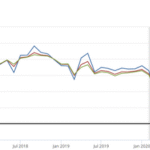

The shine has dimmed on one of Europe’s most celebrated tech champions. Over the past 11 months, ASML has seen more than $130 billion erased from its market value—a staggering drop that’s left analysts, investors, and even long-time admirers asking tough questions about what comes next for the Dutch semiconductor giant.

At its height last July, ASML was riding high on soaring demand for chipmaking tools and bullish projections around artificial intelligence. Its market cap topped $430 billion, placing it among the world’s most valuable tech companies. But fast forward to today, and the company’s valuation hovers just under $300 billion. For a business long considered essential to the future of advanced chip production, the fall has been swift—and sobering.

There isn’t one single cause behind the decline. Rather, it’s the result of a perfect storm of geopolitical strain, industry-wide belt-tightening, and shifting demand patterns. Chief among the concerns: ongoing U.S. export controls that have blocked ASML from selling its most advanced lithography machines to customers in China, one of its biggest markets.

Those restrictions, which Washington continues to tighten, have significantly reduced the company’s sales pipeline. “China wasn’t just a growth market—it was essential to the company’s long-term strategy,” said one analyst at a European investment firm. “The current restrictions don’t just hurt revenue. They force a rethink of everything from production planning to R&D investment.”

The timing couldn’t have been worse. Over the past year, several of ASML’s largest customers—including Intel and Samsung—have delayed or scaled back their capital expenditure plans. Orders for new fabrication tools have slowed, and demand for advanced EUV systems, once viewed as a guaranteed driver of growth, has tapered off faster than expected.

In its first-quarter earnings report this year, ASML posted bookings of just under €4 billion—nearly half of what it reported the quarter before. Although it stuck to its full-year revenue guidance, the sharp drop in new orders sent a clear signal: confidence is cooling.

Inside the company, there’s little appetite to sugarcoat the situation. CEO Christophe Fouquet, who took over earlier this year, has spoken candidly about the near-term pressures. While he remains upbeat about the longer-term role ASML will play in the semiconductor supply chain, he acknowledged that the road ahead may not be smooth. “We are seeing some softness in the market,” he said during April’s earnings call. “AI remains a strong driver, but recovery in other areas is taking longer than anticipated.”

There’s also a political layer complicating matters. Speculation over future U.S. trade policy—particularly the possibility of a second Trump presidency—has only added to the uncertainty. Any further tightening of export rules or new tariffs could weigh even more heavily on ASML’s international operations, particularly in Asia.

Still, the company is far from crisis mode. Its technology remains unmatched in the field of EUV lithography, and no serious competitor has emerged to threaten its dominance in the high-end segment of chip production. In many ways, ASML’s recent losses are less about the company’s core capabilities and more about the environment it’s operating in.

“Fundamentally, the company’s position hasn’t changed,” said a Frankfurt-based semiconductor analyst. “What’s changed is the global context—and the market’s appetite for risk.”

In fact, some onlookers see this as a pause rather than a pivot. Industry insiders still expect a resurgence in orders once the next wave of advanced fabs—particularly those geared toward AI and 2nm chips—come online. The question is how long ASML will have to wait, and what shape demand will take once it returns.

For now, though, the message from markets is clear: dominance alone isn’t enough. In a landscape increasingly shaped by politics, supply chain realignments, and economic volatility, even a company as strategically important as ASML isn’t immune to sudden reversals.

The next few quarters will be critical. Investors will be looking not just for stronger numbers, but for reassurance that ASML can weather this slowdown without losing momentum—or market share. For a firm that helped shape the future of technology, this may be its toughest test yet.